Floor & Decor Holdings, Inc.’s (NYSE:FND) P/E Is On The Mark

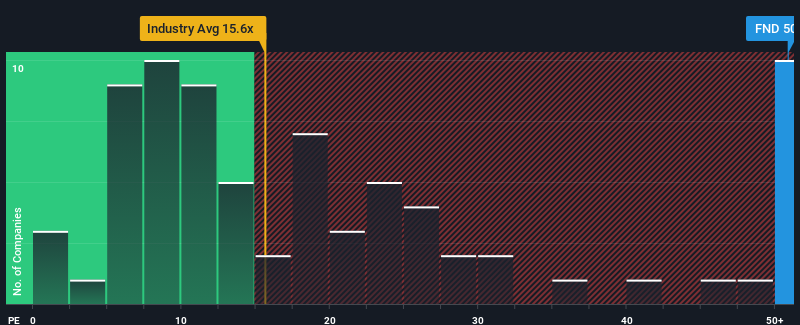

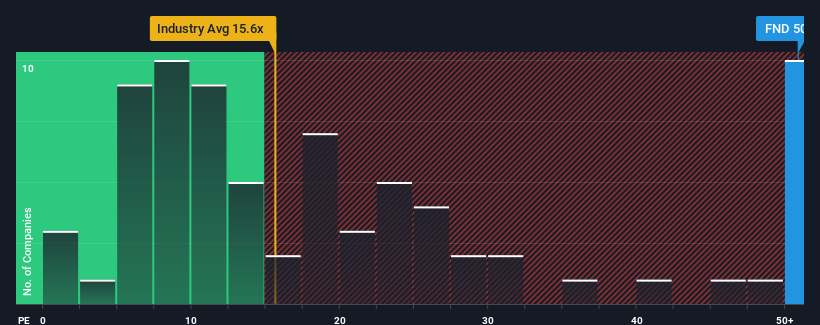

When nearly half of US companies have price-to-earnings ratios (or “P/E’s”) below 17x, you’d think. Floor & Decor Holdings, Inc. (NYSE:FND) as a stock to avoid in full with its 50.9x P/E ratio. However, the P/E may be too high for a reason and needs further research to determine if it is correct.

With earnings trending lower than the market lately, Floor & Decor Holdings has been very sluggish. Another possibility is that the P/E is high because investors think that the company will change things completely and faster than many others in the market. If not, existing shareholders may be very nervous about the performance of the share price.

Get a full review of the name Floor & Decor Holdings

Curious how analysts think the future of Floor & Decor Holdings will shape the industry? In that case, we for free A report is a good place to start.

Does Growth Equal High P/E?

There is a natural logic that a company should far outpace the market for P/E ratios like Floor & Decor Holdings’ to be considered reasonable.

If we check the last year of earnings, disappointingly the profit of the company has dropped to 28%. The last three years are also not looking good as the company has reduced EPS by 29% overall. Therefore, shareholders would have felt disappointed with the medium-term rate of earnings growth.

Looking to the future, estimates from analysts dealing with the company suggest that earnings should grow by 14% each year for the next three years. That makes it higher than the 11% annual growth rate for the broader market.

Because of this, it makes sense that Floor & Decor Holdings’ P/E sits above most other companies. It seems that many investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

Using the price-to-earnings ratio alone to determine whether you should sell your stock doesn’t make sense, yet it can be a useful guide to a company’s future.

We noted that Floor & Decor Holdings maintains its high P/E on the strength of its forecast growth that is higher than the broader market, as expected. At this stage investors feel that the potential for earnings declines is not great enough to justify a low P/E ratio. It is difficult to see the share price falling sharply in the near future under these conditions.

There are also some important risk factors to consider before investing and we have found them 1 warning sign for Floor & Decor Holdings what you should be aware of.

You may be able to find a better investment than Floor & Decor Holdings. If you’re looking for a selection of potential candidates, check this out for free a list of interesting companies that trade at a low P/E (but have proven earnings growth potential).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High Growth Tech and AI Companies

Or create your own from over 50 metrics.

Learn Now for Free

Have a comment about this article? Are you concerned about the news? Get together and us directly. Alternatively, email the editors (at) simplywallst.com.

This Simply Wall St article is general in nature. We provide commentary based on historical data and analyst estimates using an unbiased approach and our articles are not intended as financial advice. It does not make an offer to buy or sell any property, and does not consider your motives, or your financial situation. We are committed to bringing you long-term analysis focused on fundamentals. Note that our review may not cover recent releases that are not sensitive to pricing or quality materials. Simply Wall St has no position in the stocks mentioned.

#Floor #Decor #Holdings #Inc.s #NYSEFND #Mark